A wary future: Wellesley College financials explained

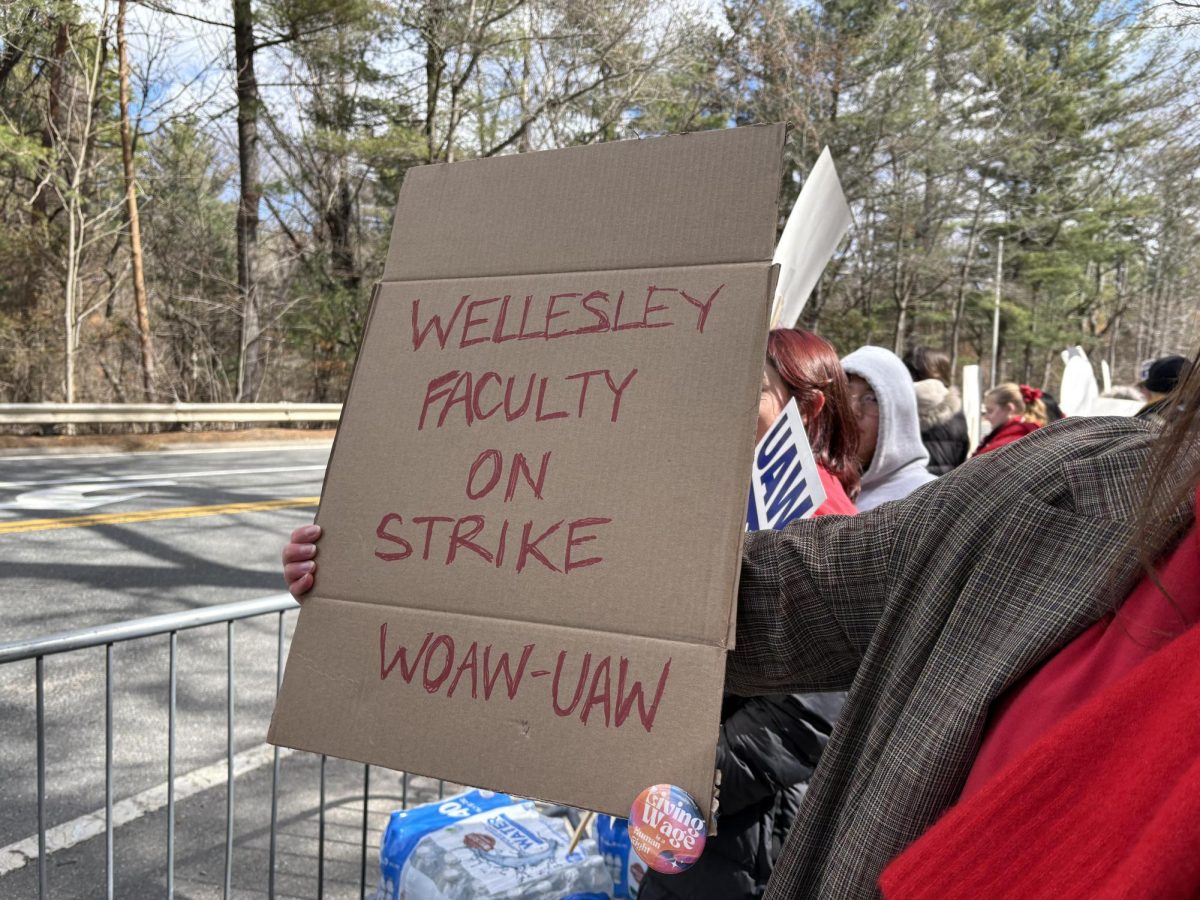

Compensation and workload were dealbreakers in the College’s negotiation with WOAW, the non-tenure track faculty union, prompting discussions on campus about the College’s finances.

The College had a large endowment and budget surplus this year, but the Wellesley News’ analysis shows a more complicated reality: the College’s finances are clouded by ongoing threats to cut federal grants by the Trump administration and internal budgetary constraints tied to long-term construction projects.

The News analyzed annual reports and tax filings and broke down some essential information about the College’s federal funding, endowment and budget.

Since January, the White House has ordered a halt on billions in federal funding, endangering research, hiring and operations at higher education institutions, including Wellesley College. This type of aggressive cut could be damaging to the College, as grants support student financial aid and faculty research.

In FY23, Wellesley received $12.8 million in federal grants, including grants to Wellesley College and pass-throughs from other institutions. The specific federal grant breakdown for 2024 is not publicly available.

That year, Wellesley received more than $9 million in student financial assistance and a combined amount of nearly $3 million from the National Science Foundation and the Department of Health and Human Services that supported research around mental health, neuroscience, geosciences, and more.

Wellesley has $7 million of unspent federal grants that could be affected.

The News reported that Wellesley received a letter from the U.S. Department of Education Office of Civil Rights (OCR), warning of potential enforcement actions if it fails to protect Jewish students on campus.

The exact magnitude of a possible funding cut on Wellesley and how it affects the College’s ability to secure future funding is still unknown, given the constantly changing political landscape.

Compared to big public research universities like the University of Pennsylvania and Harvard University, Wellesley may not be as reliant on federal grants for their overall operations, as liberal arts colleges typically depend more on tuition, endowments, and private donations.

Wellesley College currently has a $3 billion endowment, one of the largest endowments among US liberal arts colleges. In 2024, the endowment provided $123 million — approximately 43% of operating revenue.

In October 2024, the News reported on the specific breakdown of the endowment’s portfolio and its performance.

Endowment spending is now capped at 4.25% of the most recent endowment value approved by the Board of Trustees.

The spending rate is based on 80% of the prior year’s spending (adjusted for Higher Education Price Index inflation) and 20% of the current endowment value.

To prevent overspending or underspending, the policy also sets limits based on the endowment’s average value over the last three fiscal years. The allowable spending amount cannot exceed 5.0% or fall below 4.0% of this three-year average.

It is important to note the “last three years” in the spending rule here.

Over the past three years, the College has seen remarkable endowment growth. An outsized return in 2021 delivered a 46.5% return on investments, skyrocketing the endowment value from $2.3 billion to $3.2 billion.

In an interview with the News in 2022, Chief Investment Officer Debby Kuenstner ‘80 said the Investment Office believed the stellar 2021 return was pulled forward by broader fiscal and monetary policies, as no major change in the underlying economy could justify this much of an increase.

However, in 2022, the endowment fell by roughly $291 million as the overall stock market reversed 2021 double-digit gains following surging inflation and Federal Reserve interest rate hikes.

Even though the rate is set at 4.25%, the College is not bound to that specific percentage.

In FY 2020, the College drew 4.29% out of the endowment. Due to the substantial growth in the endowment value in 2021, the spending rate from 2021 to 2023 has remained below the 4.25% cap, though the total amount withdrawn has risen.

Spending will increase again in FY 2025 due to an estimated 6.7% draw.

Between 2020 to 2021, the College received around $4.3 million in funds from the federal Higher Education Emergency Relief Fund under the CARES Act, the Coronavirus Relief Act (CRRSA) Act and the American Rescue Plan.

However, the biggest addition to the budget came in 2024, when the College recorded a $15.5 million surplus, a major increase from the previous year’s $9.3 million surplus.

This notable increase is likely due to the College receiving its final installment of federal COVID-19 funds and “significant” gifts that generated income in FY 2024. It also generated interest rate income from cash the College held for paying construction projects.

“The FY24 surplus was the product of a number of unforeseen one-time events that will not recur this year or in future years,” wrote Provost Courtney Coile and Vice President of Finance Piper Orton in an email obtained by the News.

It has not always been smooth sailing with Wellesley’s operating budget. The News analyzed the past 13 fiscal years, the period from 2012 to 2024, and found that the College experienced 7 years in a budget deficit, meaning it spent more than it earned.

From 2012 to 2016, the College operated at a deficit for five consecutive years. The worst year was 2013, when the College overspent by $12.5 million.

For FY 2026, Wellesley projects $8 million in deficit, according to the same email viewed by the News.

Despite a delay in exact timing, the Investment Office expected this pullback. In a 2022 interview, Kuenstner told the News that she expected “a spending bump” in the 2024 fiscal year, approximately when the “three-year average” largely boosted by the 2021 return expired.

This projected $8 million deficit in 2026 comes as the College notched three consecutive years of operating on a surplus.

A News analysis of operating expenses from 2015 to 2024 shows that there are rising costs in instruction, student services and institutional support, but the sharpest increase is debt related to construction and repair projects.

Instruction costs rose to $81.5 million in 2024 from $70.7 million in 2015, while expenses on student services increased by 43% to $32.7 million in 2024 compared to the same period in 2015.

In connection with the College’s construction and critical repairs, the debt service, or cash required to pay back interest, doubled from $8 million to more than $16.1 million from 2015 to 2024.

During the 2024 fiscal year, the college paid $17.1 million in interest on its debt, more than the $15.9 million it spent in 2023.

The College owes money through various bonds or loans it took out via the Massachusetts Development Finance Agency (MDFA) and other sources to fund the construction of the science center and other renovation efforts.

Coile and Orton said in their email that the College underinvested in buildings for decades. While Wellesley invests in construction around campus in residential halls and academic buildings, the past is making a dent in the College’s budget, at least for the next decade.

In April 2022, the Board of Trustees voted to take $125 million out of the endowment for urgent repairs–a special draw on par with a regular endowment draw.

The College still has to budget for maintenance as it has $800 million worth of deferred maintenance in its buildings, despite renovations to the Science Center and Clapp Library.

Michelle Maheu, Director of Facilities Operations, told the News that these maintenance tasks were long overdue and the College is expected to request $14 million from the Board of Trustees for next year.

Wellesley College has additional plans to sell bonds through Massachusetts Development (MassDev) this year, Bloomberg News reported. The College confirms that it is undertaking a $142.7 million debt issuance to issue a new debt for capital projects, pay down another loan and refund two existing municipal bonds with changing interest rates.

In recent weeks, more and more higher education institutions have announced hiring freezes in response to uncertainty around federal funding.

Wellesley is not an outlier. After projecting an $8 million deficit, Coile and Orton said they may need to consider actions such as a hiring freeze and across-the-board reductions on food or travel to achieve a more balanced budget.

The College may also need to factor in the additional cost of tax payment if the existing 1.4% endowment tax rate is increased to 8.6% or 10% as proposed by Republican lawmakers. While the endowment tax is yet to be played out in Congress, the College currently estimates paying $3 million to $4 million in the fiscal year 2026.

Wellesley still pledged a $3 million increase in financial aid spending on students in FY26. Yet, with a hostile administration eyeing to strip federal funding and Wellesley’s own cash-intensive construction and maintenance projects, it paints a wary picture where the College has to tread carefully for its fiscal operations while providing for its students.