How much rent can I really afford? How much can I spend on a night out without feeling guilty? For graduating seniors and those of who will be interning this summer, these questions are very real. While entering the real world includes the fun of finally earning a regular paycheck, it also includes the burden of learning how to spend it.

To budget efficiently after graduation or during a summer internship, Wellesley alumna, Harvard MBA, and money guru Manisha Thakor recommends dividing your income into four chunks:. The first cut of the pie goes to Uncle Sam, which we will round to 25 percent of your pre-tax income. The next chunk is for your needs — think rent, student loans, transportation, healthcare, and food. Aim for this total to be no more than 45 percent of your total income. Although this percentage might not be achievable initially depending on student loan amounts and your cost of living, think of it as a number to work towards over time. Next are your expenses for luxuries, which may include nights out on the town and shopping for that new work wardrobe worthy of Olivia Pope. This category is easily the most tempting category in which to overspend, so be sure to restrict yourself to spending no more than 15 percent of your income on this. Last, but certainly not least, is what you should be saving. Strive to bank 15 percent of your paycheck when possible and your future self will thank you for years to come.

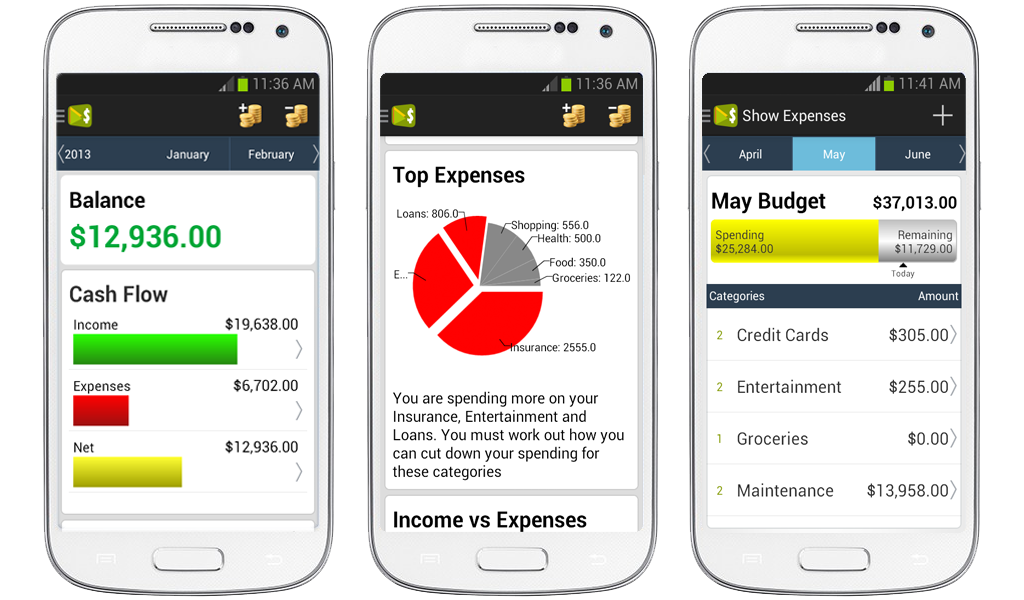

Regular small expenses like coffee runs with friends can add up to large amounts over time. While often overlooked compared to big-ticket items like rent, these expenses can significantly erode your planned savings. There are a number of methods out there today to help you track your spending. Many commercial banks, like Bank of America, have online software that will break down your spending into rough categories. Personal finance apps like LevelMoney and Mint can also be downloaded for free and offer various visual ways to keep an eye on your spending habits.

Before you can think about building your retirement nest egg, there are a few other items that you might want to consider. Your student loans will mature soon after graduation. It should definitely be a priority to pay these off sooner rather than later. There will likely be minimums you are required to pay each month, but you always have the option of paying more. If you can afford to, do so, even if it’s as small as contributing an extra $30 a month. This will reduce the length of time on your debt and therefore the total amount of interest paid, saving you money in the long run.

Once you have made progress on paying off your loans, or if you were fortunate enough not to have them, start working to build an emergency fund. You never know when a significant medical expense might arise, a layoff might occur, or perhaps a tempting new adventure will present itself. This fund should ideally equal six months of your base salary. That might seem like a big number, but don’t feel pressured to save it overnight. Rather, direct a portion of your allotted savings to this fund each month, and in time, you will reach your goal. Once achieved, you can start saving for other items like a car or future down payment.

While saving might feel like a self-imposed tax at the moment, it will pay off tenfold in the future. The reality is that the best and easiest time to start saving for retirement is actually today — and yes, I really mean as a 20 year old. Each dollar you save this year will accumulate interest for 45 years, if you work until the current retirement age, and perhaps even longer. To have money in the future for big ticket items like a car, a down payment or even retirement, worry less about the size of your current paycheck and more about your willpower to save. While keeping up with the Joneses may have been the norm in Mona Lisa Smile, the new trend is fiscal discipline.

Photo courtesy of windowsphoneapk.com